This is an area to keep up with my journey and advice to ultimately screw debt down to ZERO! Keep checking back with updates!

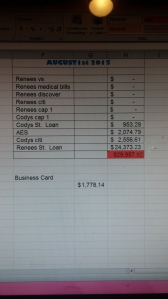

AUGUST 1ST UPDATE!

Read all about it! : here

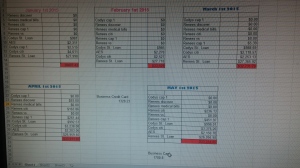

May 1st Update:

Get the scoop HERE!

April Update:

Nope, the numbers ain’t foolin’ me today. The damage is an INCREASE in debt by $1179.92. Plus, an increase on our business credit card from ZERO to $1,328.23. That makes an OVERALL total increase in debt a whopping $2508.15.

Read my post about it here.

March Update!

Debt down $777.30!

Check out my post about it: Here!

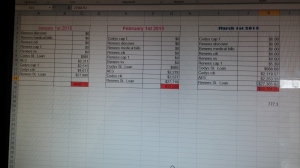

February Update!

See my 1st post about my debt journey: Here

Great job and Congrats !

Debt can be quite overwhelming, but keep up the good work.

LikeLiked by 1 person

Thank you so much!

LikeLike

Good job. Are you doing the debt snowball?

LikeLiked by 1 person

A moderated version of it, yes! We paid off (snowballed) our lowest ones first…. but then I realized my high student loan balance and high interest rate was KILLING ME. Now we are trying to at least get that down to where the accumulated interest isn’t going to break the bank on just the minimum payment. Then back to snowballing!

LikeLike

What would you say is your primary motivation for getting out of debt? Is it just a numbers thing (saving money on interest), more of an emotional thing (it feels overwhelming and burdensome), or something else? I’m always curious to hear people’s perspectives regarding debt reduction.

LikeLiked by 1 person

All of the above, really. I grew up in a family that did everything they could for me – but we were always burdened with debt and the accompanying stress regarding money and budgeting for bills. When I accumulated all this debt for myself as a young adult, I realized how emotionally draining it is to constantly worry about money. I want the freedom and peace of mind. Also, I want to learn to live a lifestyle (the numbers thing- saving money, emergency funds, retirement, reducing interests, eliminate credit cards, etc) that will sustain that peace of mind. Thanks for asking!

LikeLiked by 1 person

Awesome job working to reduce your debt! You’re much more fortunate than many people to “only” have ~$30k in debt. I myself have just under $300k in debt to my name (but that includes the mortgages on my properties). Having a plan and sticking to it puts you on the guaranteed path to success! Keep up the good work!

LikeLiked by 1 person

Renee and Cody,

Congrats on the hard work you guys are doing. It’s worth every bit of the effort. As you’re pursuing your dreams (woodworking, nursing, etc) you’ll find the ever lightening debt load will begin to push wind into your sails moving you faster and stronger into freedom. Getting out from under debt is truly freeing. Keep up the hard work!!

LikeLiked by 1 person

Thank you so much! It’s a struggle sometimes, especially this month, but every penny that goes to debt is a bit of weight off our shoulders! Thanks again for your kind words!

LikeLike

Absolutely! My wife and I had to work through $60,000 in student loans. We needed all the encouragement we could get. It was a tough journey but worth all the focus, discipline and sacrifice. Glad we’re on the other side of it now and excited to see others doing the same!

LikeLike

Wow! That’s quite an accomplishment! Thanks for sharing! Any tips are appreciated. This month we had some unexpected financial emergencies – so our debt went UP this month. It was crushing since we did really well this month with staying ‘on budget.’ But that just motivates me more because one day we’ll be like you and on the other side of debt – putting money into savings and into emergency funds for situations like these!! Have a great day!

LikeLike

You’ll get there as you maintain the energy and focus you have towards it. And honestly, a bit of getting mad doesn’t hurt. I mean, getting mad. Not some hateful mess you drag around with you, but mad enough to do something on the days you want to bail out. When frustrating emergencies hit it’s hard to stay positive, but that’s when leaning in and fighting your fight can help. Getting out of debt is not all rainbows and butterflies. You clearly know that. It’s hard work. Some days you have great joy that propels you ahead and others it’s discouragement and frustration. It’s getting back up and staying the course that will pay off. My wife and I had committed to paying off debt. We were sharing one car because mine had died. So, we saved up and bought a used car. We spent $8,000. Two months later the car died. So, I’ve been there. It’s not fun. But you guys are on the right path. You’ve got the right attitude. A bit of anger and frustration with a lot of motivation, hope and positivity. You two will get it done.

LikeLiked by 1 person

You are inspirational! Thanks for the boost! Seriously, it means a lot.

LikeLike

You guys keep it up. My wife and I’ll be cheering you on from here. Feel free to reach out anytime you’re stuck or lacking motivation. We battled through it and are glad to share our stories and tips as well as encouragement. All the best to you!

LikeLiked by 1 person