It’s that time again y’all!

DEBT UPDATE. Sorry it’s so late in the day (night haha) but I’m actually in TC with family and had to get my friend to email me my excel files from last month so I can update and compare!

I’ve learned so much this month about our spending habits vs income and about our debt expectations.

Here’s the low-down on this month:

Our new debt total is $31,483.21, and was reduced $1,830.84!!

There are some BIG howevers, however.

That may seem like a great decrease – and it is… HOWEVER, it should have been a lot more.

We hustled our little butts off! We had a million side jobs, totaling at least another thousand in extra income.

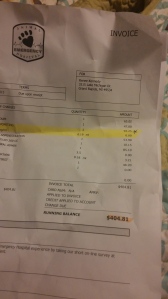

One unforeseen circumstance is my poor pup got into two entire bottles of my vitamins and had a huge $400+ vet bill to pump his tummy, IVs, lab work, etc. Before you yell at me, YES I keep my meds up and away, but my cat likes to climb into cupboards and shove everything out of them. Louie then gets everything that falls. Ugh. haha

Then Cody had to renew his builders license and pay for his continuing education credits, which was another $500.

Another BIG however was how much we spent on crap we didn’t need. For the first time, we DID write down EVERYTHING we spent. IT WAS A LOT! We tried to live ‘normally’ so we could see how much money we easily waste, and it really was an eye opener. When I get back to Grand Rapids, I will either scan the pages and/or add up totals of categories for you all to see how horrible we were at this and to compare our spending to income ratios. It’s really a lifestyle change, and it’s hard!

It was CRAZY to realize how quickly things add up and how easy it is to spend money!

I am so blessed to have the debt still decrease after our horrid spending, and the emergencies and necessities of this month. We learned a lot about ourselves, our goals, and how to create a reasonable and reachable budget. Cody and I created that actual budget, and an excel sheet for the budget categories, and have also started to utilize the envelope system. (I actually have this awesome wallet with dividers we use for each category). I’m excited to see what damage we can do on our debt if we stick to our planned budget, still write everything down, and eliminate any unnecessary purchases and splurges!

A final however is our business credit card actually INCREASED by $599.93, and will probably increase by another $600.00 this next month. We have three markets, shows, and festivals in the next two months, and needed to pre-order our bamboo since it can take up to 4 weeks to receive! Its a kick in the butt after having a slow, but successful month! We are slowly gaining more sales and positive feedback. On Etsy we have only 26 sales totaling about $600.00 in revenue, but we have done custom orders for a few shops in our hometown. I feel so happy that after only being open for about a month and a half to have business starting to roll in! Now, if we can only get into the POSITIVE!!! 🙂

Looking forward to this next month of frugality, selling, hustling, and working! 🙂 DEBT BE GONE! 🙂

Congratulations. You go girl. Whittle away that debt.

Something I found that helped me years ago when I wanted to watch my spending is I paid cash for everything. I did a budget, and knew exactly how much I spent for gas, food and hair cuts. Then, I stopped using my debit card for everything. I still do this and it makes a big difference psychologically when you part with real money verses plastic.

Just a thought.

Shine On

LikeLiked by 1 person

Oh gosh absolutely! I find myself so much more ‘stingy’ by using cash instead of plastic! I’m hoping that it will help us make a bigger debt decrease this coming month! 🙂 Thanks for the encouragement!

LikeLike

Congratulations! I was happy to have actually paid my dad some money I owed him today. It is so nice being able to lower costs. The unexpected will always come up, but just knowing that you are getting a better handle on things seems to make those times easier to swallow (no pun intended with the vitamins) doesn’t it. And just to let you know, my first thought when I read that your dog ate the vitamins…before the explanation was, “I bet she has a cat that got them open or something.” That’s cats for you! We had to put child proof latches on our cabinets in our old apartment to keep one of our cats out!

LikeLiked by 1 person

Thanks so much! It does feel great to lower costs, even by a little! 🙂

And I never ever thought that cats could be so mischievous haha – We actually picked up some child proof locks the other day for that reason!

LikeLiked by 1 person

HA! One of our cats figured them out, but then lost interest in those cupboards. Hope they work long enough for you.

LikeLiked by 1 person

One day at a time my dear. Keeping going. Am inspired.

LikeLiked by 1 person

Thank you!

LikeLike

Great job on your focus, determination and progress. Not a lot of people have what it takes to even accept their debt, most would just let it go to collections. It demonstrates a tremendous amount of responsibility. Keep it up!

LikeLiked by 1 person

Thank you! I appreciate that. I feel like such a failure sometimes for being so young and having so much debt (it seems like an enormous load to me and my income bracket haha) – but I have the rest of my life handle money in the way that will allow me the most financial freedom – and I’m excited for that journey! Thanks!!

LikeLiked by 1 person

As long as you’ve learned from failures, that’s a win! There is always a lesson to be learned with anything. Figure out how you’re going to flip that failure into a positive and make it pay you back. Then you’ll have a whole new perspective 🙂

Best wishes.

LikeLiked by 1 person

You are doing a great job paying down this debt! Even a little bit can go a long way! Getting rid of debt takes time! 🙂

LikeLiked by 1 person

It does! I’ve always been the impatient kind of girl, but a lifestyle change and debt payoff takes time and patience and dedication – I’m learning that!

LikeLiked by 1 person

Check out Dave Ramsey. It helped me a lot to kick my debt to the curb.

LikeLiked by 1 person