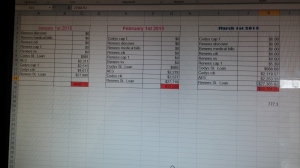

March 1st is already here, holy balls.

As promised, I’m here today to deliver the progress made during the short, frigid, and depressingly grey month of February.

We managed to reduce our debt by $777.30!

That may seem like decent progress, but it’s still less than what I expected. Since I am still not employed, we are living off of Cody’s income, which is only $3,040 BEFORE taxes. My only income this month was a measly $300 selling things on eBay. I did recieve $100 from family as a gift, and we returned bottles for $37. All in all we had about $2540 and change to live off of for the month. When I was working we made more than double that, so it’s definitely been struggle to budget and create a different (but better) lifestyle.

I was horrible at keeping track of where our money went this month – once I got so far behind I just kicked up my feet and watched it fly away. Bills, student loan payments, and small necessities were soul crushing enough, but we also had to make multiple trips to see my lawyer 3 hours south (not cheap). Cars of course never work when you want them to, so a part for my rusty-trusty Malibu grabbed $120 out of my pocket after a trip to Traverse City to see family. Oh, not to mention the vet bill for Louie’s immunizations. Today, in the bank account, we have $.01. Not a joke, just sad. We do have $50 in cash, though – if that makes it look any better!

But at least it went down! I’m more blessed than many.

March should be a bit better. We hope to live off of cash only this month, and like I stated, we have $50 to get us through for food until payday this Friday. Plus, since we gave up eating out for Lent, we should save a lot of money on food and alcohol this month. I plan to STICK TO writing EVERY expense down this month, so please hold me accountable if I do not add that sheet to April’s more in-depth debt update. I want and need to know how we spend EVERY PENNY, that’s the only way that old habits can be broken. Hopefully eBay will remain a small source of side income this month as well, as I continue my journey to minimalism (less crap!). I also plan to call all of our providers/utility bills, etc (even some for a second time) to see if any rates can be reduced or eliminated. Like last month, cutting Comcast down from $160 to $39.99 was insanely awesome!

And most obviously, I am still job searching and will probably apply to some part time jobs and freelance while my search and current predicament continues (FEEL FREE TO HIRE ME! ha ha). We have also been in the process of opening a small home business, so hopefully that can get up and running by next month to further help debt and start our entrepreneur dreams! Our start up costs were pretty low so far, God forbid let’s keep it that way. Once it’s ready, I’ll definitely share that side of us with you guys!

Hopefully those of you who are struggling with debt made some progress last month as well. Feel free to share your stories and tips! We are all in this together!

Reblogged this on Felicia's Mag.

LikeLiked by 1 person

Weare in a very similar boat! This month we managed to pay off our credit card- which was an exciting deal! I totally get calling all the utility companies too. Sometimes you just have to hound them a bit to make YOUR life a little bit easier! I’m getting ready to start paying off those kidney stone debts- so I feel the struggle! Keep plugging along

LikeLiked by 1 person

Oh, I definitely understand the kidney stone debt – been there multiple times myself! Congrats on paying off the credit card! We are about one or two months from that as well! Keep up the good work and keep us updated!

LikeLike

Don’t give up!

I went from disabled and $100,000 in debt to handi-capable and debt free (aside from a little bit on mortgage).

If only I had known about Dave Ramsey’s Baby Steps.

Sigh.

At 24, you’re ahead of the game.

He has a great budgeting tool called Gazelle Lite.

He might suggest “scorched earth” budget and dog-walking. “Cut cable”-I did that. “Don’t see the inside of a restaurant unless you work there.” Really hard.

“Give your money marching orders each month.”

“Live like no one else now, so that later, you can live like no one else.”

It’s not forever.

You can do it!

LikeLiked by 1 person

WOW! Thanks for all the tips and great advice from you and Dave Ramsey, haha. I appreciate it. And an HUGE congratulations on your debt payoff! That is AMAZING.

LikeLiked by 1 person

30+% of 2540 is pretty friggin’ awesome! Well done. If you are paying for broadband, you can probably kill the cable and still numb your brain w/plenty worthless programming via laptop/phone/pc. Cut your alcohol in half, you get the double benefit of change in your pocket plus half the calories of your regular beer. No lawyer is worth driving 2 hours for (unless you are discussing your lottery winnings), so I would go SKYPE baby on that one. Good luck and Godspeed.

LikeLiked by 1 person

Thanks for the tips! Cutting down on alcohol is a biggie- both for cash and calories! And my lawyer and I are definitely doing skype from now on – we just had a few meetings that HAD to be in person.. ha. Thank you for the tips and I appreciate the kind words!!

LikeLike